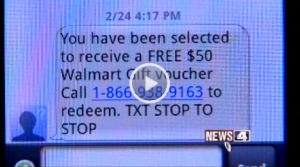

Technology often creates problems. With the advent of gift cards and the electronic systems behind them, came the potential for problems and abuse. We’ve seen plenty of examples of where technology has been used against retailers and consumers such as in the fraudulent cloning of gift cards and siphoning of their funds. What you may not know is that there are also plenty of examples of when gift cards have stopped working properly, either through bad design or human error.

This story probably falls in that last category.

Last December, I paid cash to obtain $800 worth of American Express gift cards to give as Christmas presents. In March, my son tried to use his card. He was told that there was no money left.

He and I both placed calls to the customer service number on the back of the card. We were each told the money on the card had been sent to the Massachusetts Unclaimed Property division. The card said it was valid thru April 2014.

I contacted the Unclaimed Property, as suggested by American Express customer service. The first time, the Unclaimed Property division said nothing had shown up. I again tried to reach American Express, which said they could not add money back to the card without the receipt. I couldn’t get any answers about what happened.

This kind of thing happens all too often. But what makes the difference between feeling taken advantage of and getting a problem successfully resolved is the persistence of the customer and the ultimate nature of the company involved. I’ve seen lots of frustrating stories from people about American Express gift cards, but I’ve also seen some examples where the company has gone out of its way to right a wrong, when the customer was persistent enough to pursue a resolution when he was initially rebuffed.

You might find that the company that issued the gift card is quite reasonable and will fix the problem without too much fuss. Or you might find that it takes some persistence to get your problem resolved. What people don’t realize is that if no one complains about problems, companies have little reason to improve; it simply isn’t enough of a both. I personally do my best to pursue any matter where I feel that I’ve been treated unfairly, even if it is for a few dollars and even if it is just writing a letter to a company to tell them why I will no longer be doing business with them.

Here are some tools you can use in increasing level of escalation:

- Call regular customer service

- Ask to speak to a customer service manager

- Search Google or Bing for executive level contact information for the company and write them letters

- File a Better Business Bureau complaint

- File a complaint with your state’s departement of consumer affairs

- Contact your local TV station or newspaper consumer advocate and ask them to contact the company on your behalf

- File a story at Consumerist so others will see your experience

- Share your experience on Twitter. Many companies monitor Twitter and respond to complaints.

- For financial products, file a complaint with their state or federal regulator, such as the Federal Reserve.

- If you believe the company has behaved in a criminal manner, contact your state’s attorney general to file a complaint. State Attorneys General will pursue investigations if enough people complain.

The point is, there are lots of ways you can pursue resolution beyond simply calling customer service.

Even better, search Google or Bing BEFORE you buy a particular gift card to see what other people are saying about the company. Try searches like “company_name gift card sucks” or company_name gift card problems.”

Sometimes, none of these things work. I had an open-loop gift card that showed no balance when it should have had $25 on it, as it had never been used and neither the website or customer service number provided a way to get in touch with a human. None of the tools above worked. But I felt good knowing I had tried to get resolution.

In the story above, here is what happened:

After presenting the situation to the folks at American Express, they dug in to figure out what happened — which apparently got a little confusing along the way — and then righted the wrong.

When you’re about to try to gird for a fight with a company, take the time to be sure of the facts and gather up all the documentation you can to help make your assertions as clear as possible.

First, in sorting things out, they found out that cards purchased in December were used. But the provided card number was indeed still valid and should have had money on it.

She said she couldn’t address what might have been said along the way in those customer service calls, but did explain the only reason there is an expiration date on the cards is so transactions can be processed.

“As funds on American Express Gift Cards never expire, we are sending her a replacement gift card with the remaining balance,’’ American Express spokeswoman Vanessa Capobianco said.

Ah yes, one more thing to remember, act reasonably and be nice to the people you talk to. In the slim chance that you are wrong, that will help save-face considerably, and it might actually help you get resolution faster.

RSS