I’ve sat back silently and watched all the hubub about Facebook gift cards over the last couple of weeks, waiting until I had enough information to form a good opinion.

If you haven’t heard, the big news is that Target will be selling Facebook gift cards. I think the reason that this is so widely reported on has more to do with the fact that Facebook is a media darling and anything related to Facebook tends to get reported on.

When you buy someone a gift card, hopefully you are buying them something they can use. If you happen to give someone a gift card that is really useful to them, such as giving a Home Depot or Lowe’s gift card to someone in the middle of a home improvement project, it can be as good as giving them a personalized gift; you obviously put though into the choice of gift card just as you might have put thought into the choice of a normal gift.

When you buy someone a gift card, hopefully you are buying them something they can use. If you happen to give someone a gift card that is really useful to them, such as giving a Home Depot or Lowe’s gift card to someone in the middle of a home improvement project, it can be as good as giving them a personalized gift; you obviously put though into the choice of gift card just as you might have put thought into the choice of a normal gift.

But above all, if the gift card isn’t useful, you might as well be giving rocks. For instance, if someone gave me (a man) a lululemon gift card, that would be a pretty useless gift.

That is one reason I personally like Amazon.com gift cards so much; there is a 100% chance I would use it, and use it immediately.

So what about Facebook gift cards. Facebook gift cards are for Facebook virtual currency and can only be used in games and applications hosted on Facebook, although there is a possibility that they might be used on non-Facebook games as companies like Zynga (the largest Facebook game developer) become more integrated with Facebook credits. Facebook has 500 million users, so Facebook gift cards are a good choice, right?

Not so fast. According to this report, one in five Americans has played a game on Facebook. Notice the important distinction between “plays games’ and “has played a game”. This means that the percentage of people that are active Facebook gamers could be substantially less. Let’s say that 1/2 of those that have played a game are active Facebook gamers. That means that if you randomly gave a Facebook gift card to someone, you have a 10% chance of them finding it useful. Clearly, this is not the general purpose gift card to give just anyone.

But, if you happen to be on Facebook, figuring out which of your friends is an active gamer is pretty easy as Facebook games so often produce those annoying update messages.

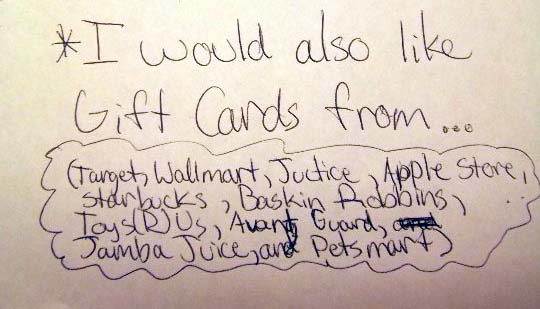

The point is, when giving a gift card, think about your choice of gift card as you would your choice of any other gift. Think about getting the person something they will use and appreciate. If they are an active Facebook gamer, by all means, get them a Facebook credits gift card. If they love music, own an iPod, and frequently use iTunes, get them an iTunes gift card.

Thoughtful gifts are always more appreciated than thoughtless ones.

RSS